A flawed and deceitful rant against free markets in the guise of an objective analysis about the dynamics of capital. Piketty focuses almost exclusively on the inequality of wealth/capital and its accumulation. He then spends vast portions of the book attempting to put this inequality in a bad light without clearly articulating why. Couple that with a tendency to qualify every claim so as to avoid taking a definitive stand and you have a book that leaves you more confused and less informed about the topic, the dynamics of capital, than you entered with.

I'll update this review as I continue to chew over the book's many claims/assertions.

Conceptual realism has muddled the comprehension of the concept of capital. It has brought about a mythology of capital. An existence has been attributed to “capital,” independent of the capital goods in which it is embodied. Capital, it is said, reproduces itself and thus provides for its own maintenance. Capital, says the Marxian, hatches out profit. All this is nonsense.

-Ludwig von Mises (1949) Human Action.

In his discussion of capital in Human Action, von Mises provides both a clear definition of capital and how to avoid the dangerous concept that capital is a homogenous, money-like good that can be seamlessly converted from one form to another. Rather, capital is a definitive set of physical or non-physical (e.g. skills) goods that are intermediate steps toward fulfillment of a specific aim, e.g. a time-saving machine to help bake more cakes. It is this line of thinking, were capital is always a definitive thing and not some amorphous concept, that leads one to conclusions that have some semblance of reason and avoid massive logical leaps. This stands in sharp contrast to Thomas Piketty's book, wherein the definition of capital and wealth appears to shift and morph throughout, at some points being considered as physical and at other times purely monetary.

This review will focus on a single, overarching point: that Piketty's book, while informative, should be read with a great deal of skepticism and his claims to objectivity should not be taken at face value.

Piketty's Capital in the Twenty-First Century is quite remarkable in its ambitious undertaking to analyze historical trends of capital formation. Yet, it utterly fails to provide a concrete definition of capital, demonstrate how that definition may have changed over time, how the actual type of capital accumulated has changed, and why there might be a concentration of specific types of capital in the hands of fewer people more recently. That is what I was expecting going into the book. However, rather than build a solid foundation and explain the many assumptions in his 'theory' used to explain the historical record, he quickly jumps to the historical record, makes conclusions, and presents the idea that if r>g (r = rate of return on capital, g = growth rate of the economy) then wealth will accumulate in the hands of the few and that this is the cause of the increased concentration of wealth seen today. In his own words, "People with inherited wealth need save only a portion of their income from capital to see that capital grow more quickly than the economy as a whole." This is the thinking that von Mises exposed as logically unsound over 60 years ago and yet it is sprinkled throughout the book. The rest of the book consists of what-ifs, exaggeration of non-significant trends toward increased weal accumulation at the top (nearly all of which seems to be explained away as a return to normalcy following the destructive effects of World War II), and weak attacks on 'patrimonial' capitalism.

The information conveyed by historical experience cannot be used as building material for the construction of theories and the prediction of future events. Every historical experience is open to various interpretations, and is in fact interpreted in different ways.

-Ludwig von Mises (1949) Human Action.

An underlying assumption/statement in the book is that inequality in wealth or income is bad (or disadvantageous to the smooth functioning of society). This is never directly demonstrated in a clear or logical fashion. Nor is it clear why this moral judgement is warranted in a book attempting to study the state of capital in the 21st century. Piketty continually tries to be appear objective, but then has statements along the lines of "the right solution is a progressive annual tax on capital. This will make it possible to avoid an endless inegalitarian spiral while preserving competition and incentives for new instances of primitive accumulation." [emphasis added] And his analyses often point toward obvious questions left unanswered:

- If the best way to reduce wealth accumulation is to tax, what does this mean when wealth isn't monetary?

- If wealth is land, how does this help with his redistribution, democratizing aims?

- How do you transfer capital stock from one person to another if that stock is an invested technology, land holding, machinery, human capital, or some other non-convertible, illiquid form of wealth?

- Why is there no concrete discussion of the basic assumption in his data, that dividing by country is the best method of analyzing wealth?

There is no discussion of certain industries, such as petroleum or other raw materials, were a large amount of capital, from machines to land and skilled labor, must be accumulated before it can be put to use. Is accumulation of capital in this enterprise, where it is not liquid and can only be put to very specific uses, 'bad' or problematic as Piketty claims? Unclear, because the actual heterogeneous nature of capital is very rarely discussed in detail.

In contrast to these problems, Piketty does an admirable job of presenting the historical data and discussing at length about why previous studies ran into problems. He highlights the biases present, due to mainly having data from Western (USA and Europe) or westernized countries (e.g. Japan), but stresses that similar trends seem to hold when looking at the scant data from other countries. I'll discuss this later, but if he spent more time talking about potential ways to gather historical data on capital when governments did not, e.g. business ledgers, that would have benefited both the reader and future researchers.

Beyond the issues outlined above, there are several other issues with the work: continual off-hand remarks about the reliability of the data he uses to make his arguments, strawmen (he often says that people assume blank, e.g. that capital structure has changed between 19th century and today, without really detailing who and what their arguments are), and a tendency to rush to conclusions without really explaining the logical steps (he'll often present a lot of historical data, then jumps to conclusions that supposedly support his hypotheses). These problems reduce the book's ability to convey a logical, trustworthy accounting of 21st century capital and are more worrisome to me than my disagreements about his conclusions about what actions should be taken given the findings in his work (e.g. the world-wide progressive tax on wealth).

Piketty often qualifies both to the arguments and the data presented. Nearly every chapter is sprinkled with, "to be sure, this data should be taken with a grain of salt". Piketty continually writes as if he is trying to hedge his bets and give himself room to wiggle out of counter-arguments by always providing an asterisk to his claims along the lines of "yet, it is possible that the trend I predicted could be the opposite and I acknowledge this fact while providing some strawman argument to counter it".

There is never a discontinuous break between social classes or between “people” and “elite.” For that reason, my analysis is based entirely on statistical concepts such as deciles (top 10 percent, middle 40 percent, lower 50 percent, etc.), which are defined in exactly the same way in different societies . This allows me to make rigorous and objective comparisons across time and space without denying the intrinsic complexity of each particular society or the fundamentally continuous structure of social inequality. [emphasis added]

-Thomas Piketty (2013) Capital in the Twenty-First Century.

Piketty chastises others for using unscientific words like 'middle class' to describe the middle 40% of wage earners and then proceeds to subtly hint that while European wage inequality between the top 0.001% and others hasn't reached Anglo-Saxon levels, one should not wait until that point to fix the problem. This mixing of ostensibly objective phrasing with use of particular words— 'inequality', 'egalitarian', 'class', 'danger', etc.—lead one to believe that he is likely cherry picking his data to serve a purpose other than to enlighten the reader about what 'capital' means in the 21st century. Piketty also has a tendency not to refer to specific facts/sources when making claims, e.g. "For example, some people use the term “middle class” very broadly to encompass individuals who clearly fall within the upper decile (that is, the top 10 percent) of the social hierarchy and who may even be quite close to the upper centile (the top 1 percent)." Who is some people? There is no source provided in the passage.

From the outset, political economy sought to study scientifically, or at any rate rationally, systematically, and methodically, the ideal role of the state in the economic and social organization of a country. The question it asked was: What public policies and institutions bring us closer to an ideal society? This unabashed aspiration to study good and evil, about which every citizen is an expert, may make some readers smile. [emphasis added]

-Thomas Piketty (2013) Capital in the Twenty-First Century.

The above quote is what Piketty says economic science political economy is about rather than the study of by what actions specific aims can be obtained or how good are produced, distributed, and consumed. Piketty does this kind of re-definitions often, many that add a political (e.g. forcible action) bent to a non-political process. What is an ideal society? Why has he altered the study of capital to be something with the end goal of how capital should be forcibly transferred from one person to another (taxation)?

This feeling of an ulterior motive guiding the book is further reinforced by a favored term of his, 'patrimonial capitalism'. The term begins to creep up in the book. It is an ill-defined phrase (he literally introduces it without defining what he means by it, "Yet at the beginning of the twenty-first century Europe seems to be in the avant-garde of the new patrimonial capitalism, with private fortunes once again surpassing US levels.") that he uses to insinuate that capitalism (whatever that ill-defined, loaded term means in his book) has some forceful control over the actions of men, when that is contrary to fact. He uses the term rents (one with specific economic meaning, but in the case of a layman-focused book like this comes as a loaded word, which Piketty is undoubtedly aware of) instead of revenue when referring to oil producers and others who earn money through means he appears to deem illegitimate.

Further, while this book is appears to concern capital in the 21st century, it is really about the evolution of capital/wealth/income inequality in the 20th. More worrisome, the data/focus of the book seems to be exclusively on percentage differences, rather than looking at the absolute change in capital/wealth. He rarely gives absolute numbers, instead preferring to use percentages. For example, although the wage inequality has risen sharply between the top 1% and the rest, if everyone was much richer in terms of purchasing power, this would be interesting from a class struggle perspective but not from an analysis on the limits of wealth and how wealth will be affected by fundamental changes in workforce environment as the information technology revolution matures (as Brynjolfsson and McAfee did in the excellent Race Against The Machine). This leads to further questions:

- Is there a maximum attainable stock of capital?

- How is capital quantified when it is made up of electrons and photons?

- Given asset bubbles, how does this affect calculation of capital stock (since in the end he does capital calculations in monetary units)?

- How has the composition of capital changed rather than the percent flow to a particular group in the population?

These questions are glancing answered by Piketty and many are never even addressed.

The second difficulty—and no doubt the major problem confronting the marginal productivity theory—is that the explosion of very high salaries occurred in some developed countries but not others. This suggests that institutional differences between countries rather than general and a priori universal causes such as technological change played a central role.[…]The divergence between the various regions of the wealthy world is all the more striking because technological change has been the same more or less everywhere: in particular, the revolution in information technology has affected Japan, Germany, France, Sweden, and Denmark as much as the United States, Britain, and Canada.

-Thomas Piketty (2013)Capital in the Twenty-First Century.

Piketty also tends to make claims that indicate a lack of research into the topic. For example, he claims at one point in the book when talking about the spectacular rise in wage inequality between the top percentiles and the rest of the workforce, that the significant rise in the United States could not be due to differences in technological ability, as many people claim due to the advent of the information technology revolution (see above quote). However, a simple glance at the top technological firms (List of the largest information technology companies, List of the largest software companies, List of largest Internet companies) shows a dominance of US firms to the near exclusion of European firms. The spectacular revenue and market capitalization numbers from tech firms would lead one to expect that the United States would have a concomitant increase in the number of young or old billionaires who originally had large stakes in these same tech companies they founded (a starting point would be List of billionaires, but would want this separated out by inherited vs. self-made). This analysis can be done in greater depth, but this took little time to do and makes Piketty's flippant claim that the United States and Europe should be equal in terms of the technological prowess of the top percentiles appear ill informed and displays a lack of precision in analysis that runs throughout the book.

This shoddy line of research and logic continues when taking Piketty's claims about capital accumulation seriously. For example, there is an underlying assumption that capital is accumulating because the same people (or families) have been, are, and will continue to be wealthy. Using this logic, Piketty at one point decides to obscure the truth to a large degree, claiming that income mobility upward (and back down) is low in the United States (see the chapter Do Educational Institutions Foster Social Mobility?). There are many reports that have shown these claims to be on shaky ground, such as the Tax Foundation's excellent article Income Mobility and the Persistence Of Millionaires, 1999 to 2007. Briefly, just by looking at tax filings one can deduce that there is a large amount of turn-over in the number of people who continually stay in the upper quartile. This is similarly reflected in the list of billionaires, which is predominately made up of self-made people (see Self-Made Billionaires Prove Piketty Wrong About Wealth).

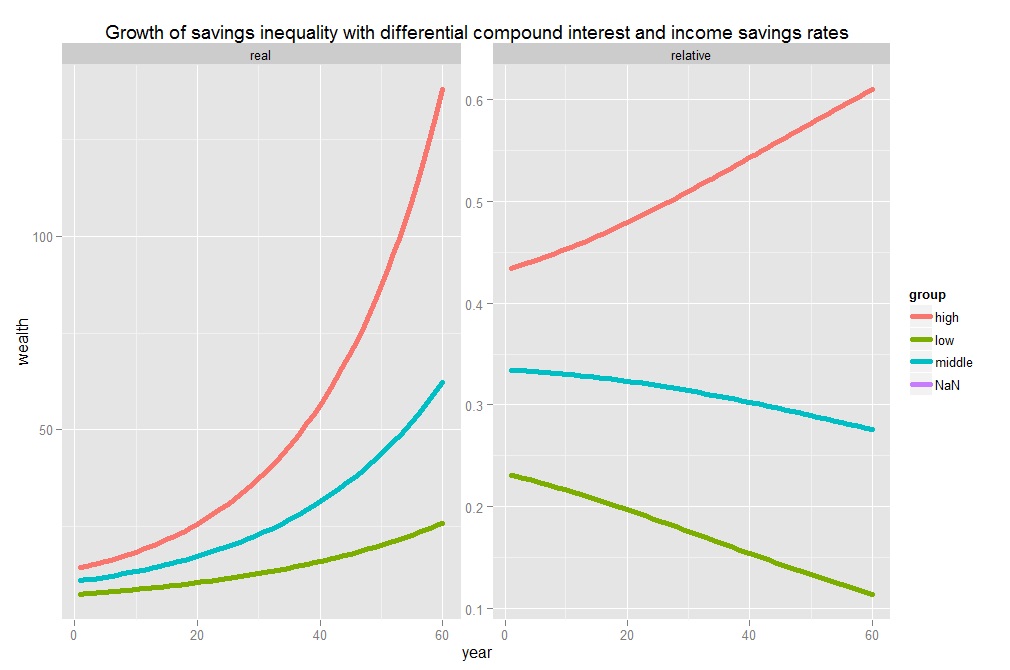

There are other times when Piketty seems to ignore arguments that he himself sets forth, such as when he is discussing the apparent logical gap between small income inequality and vast wealth inequalities that could arise. But just doing a very basic calculation of wage inequality combined with a slightly higher (1-2%) difference in return on capital for high wage earners (assuming top earners are better positioned to take advantage of high interest rate accounts as Piketty claims) and a greater savings rate leads one to predict a slow, steady rise in the share of 'wealth' (or monetary savings to be more precise) that those with higher incomes have, even over a 60 year period with only small differences in initial incomes and savings rates. See the below plot, R code at the end of the review. The fact that this seems to be casually ignored and implied to be some sort of surprise is rather insulting to the reader.

As noted at the beginning, Piketty sometimes hides behind how incomplete the data is and criticises others theories because they didn't have sufficient data, rather than on whether they were correct a priori (see the chapter Pareto and the Illusion of Stable Inequality). At various points he spends inordinate amounts of time back-pedaling on the data, saying one can't draw definitive conclusions and that 'of course, this depends on the specifics of the country'. This extends to his criticism of other people's attempts at collecting wealth data. When discussing the failings of the Forbes and other magazines wealth rankings, Piketty comes off as nothing more than ranting with little suggestions as to specific ways the rankings can be improved. He calls them worthless, but this can hardly be true. They are not complete, but they can point a way towards a more complete understanding of wealth accumulation and distribution. Further, he tries to point out some irony in the top banks attempting to compile rankings of the top wealth earners, but there is none as they would have an interest in getting this knowledge public so they can find more clients.

Every experience is an experience of something passed away; there is no experience of future happenings. But the experience to which the natural sciences owe all their success is the experience of the experiment in which the individual elements of change can be observed in isolation. The facts amassed in this way can be used for induction[…] In the case of natural phenomena the interpretation of an event must not be at variance with the theories satisfactorily verified by experiments. In the case of historical events there is no such restriction. Commentators would be free to resort to quite arbitrary explanations. Where there is something to explain, the human mind has never been at a loss to invent ad hoc some imaginary theories, lacking any logical justification. [emphasis author's]

-Ludwig von Mises (1949) Human Action.

At other times, Piketty oversimplifies history to a gross degree. For example, he brushes off the late 1920s and early 1930s world depression as a repudiation of laissez faire policy ("The traditional doctrine of “laissez faire,” or nonintervention by the state in the economy, to which all countries adhered in the nineteenth century and to a large extent until the early 1930s, was durably discredited.", chapter France: A Capitalism without Capitalists in the Postwar Period). Yet one would be hard pressed to call the policies of many nations during the time laissez faire, or more precisely pro free trade/market, in the strict sense of the terms. Many countries had adopted decidingly anti-free trade policies and large manipulations of the money supply to ensure their countries weren't drained of gold (e.g. especially Great Britian with regards to the later). As noted before, it is this type of writing that leads one to believe that Piketty is attempting to look fair and objective without actually being so.

There are other times where Piketty claims one thing then later on claims the exact opposite. Case in point, when discussing the role of government bonds in promoting inequality of wealth, he notes that in the 19th century it necessarily follows that the rich got richer since they were most likely to have enough capital to invest in high interest rate (5%!?) British government bonds. However, later on when discussing 1950s inflation in Britain that was used to drive down public debt, he claims that the effects of this redistribution were not even and most likely fell on those with little income and most likely to hold government bonds. This kind of unexplained change in logic, which one might not notice if reading the book over multiple sittings or large spans of time, nonetheless become readily apparent when the book is read quickly and with his various assertions kept in mind.

Further, Piketty attempts to use the writings of Jane Austin and other novelist of the 18th/19th century to justify his claims about the static nature of wealth and the existence of a stable 'renters' class back then. But an omission of facts by an author in a book does not imply the automatic acceptance of those facts existence by the entire population, as Piketty is wont to claim. Logical leaps like this are abound. He then uses House, Bones, and other modern TV series to illustrate that in modern society, the focus has shifted to a skills, education, and job earnings gap rather than one of wealth, with those inheriting wealth being looked down upon. Rather than show any studies or use additional reference (such as primary diaries and other sources from 18th century to now), he appears to make sweeping judgements about the perception of inequality in society with very weak examples and support.

There are many other problematic areas in the book

- What are the counter-intuitive consequences of a progressive income tax?

- His continual references to Marx's erroneous hypotheses about the 'contradictions' of capitalism without criticism.

- The underlying assumptions of a static economy built into his equations and theories.

- Etc.

But rather than continue on I'll just end the review as some of my major issues with the book have been addressed above. I would only recommend this book to people who will be continually on their toes and critical while reading, rather than just absorbing what Piketty asserts. The book is highly misleading and his mixing of light economic theory/hypotheses ('laws'), breezy historical overviews, and lazy socio-political analysis is done in an eloquent writing style that can cause readers, working through the book over weeks to months, to overlook the many logical gaps and omissions of information, assumptions, and arguments. To end, I will quote from Mises's Human Action once more, as it is succinctly describes what Piketty does the opposite of in Capital in the Twenty-First Century:

It is true that economics is a theoretical science and as such abstains from any judgment of value. It is not its task to tell people what ends they should aim at. It is a science of the means to be applied for the attainment of ends chosen, not, to be sure, a science of the choosing of ends. Ultimate decisions, the valuations and the choosing of ends, are beyond the scope of any science. Science never tells a man how he should act; it merely shows how a man must act if he wants to attain definite ends.

Some additional reading relating to Capital in the Twenty-First Century and it's topics.

- Thomas Piketty and Mises’s ‘The Anti-Capitalistic Mentality’

- Harder for Americans to Rise From Lower Rungs

- Study: Economic mobility depends on the state you live in

- Does America Promote Mobility as Well as Other Nations?

- How Piketty is wrong—and right

- Turning Piketty Right Side Up

- # small scrip to demonstrate wealth inequality from income inequality

- # biafra ahanonu

- # stated 2015.06.18

- initialWealth=income*savingsRate;

- years = 1:60

- }

- thisTable$wealthType = 'real'

- ggplot(thisTableAll,aes(year,wealth,color=group))+geom_line(size=2)+facet_wrap(~wealthType,scale="free_y")+

- ggtitle('Growth of savings inequality with differential compound interest and income savings rates')

stanford

stanford linkden

linkden github

github goodreads

goodreads medium

medium twitter

twitter